(Reuters) -Icahn Enterprises on Wednesday warned of a sequential decline in its indicative net asset value in the fourth quarter, sending shares of the investment firm, which named insider Andrew Teno as its CEO, down 11%.

The drop in a key metric that gauges the value of a fund’s assets adds more pressure on IEP’s stock, which saw a selloff last year after short seller Hindenburg Research bet against the firm.

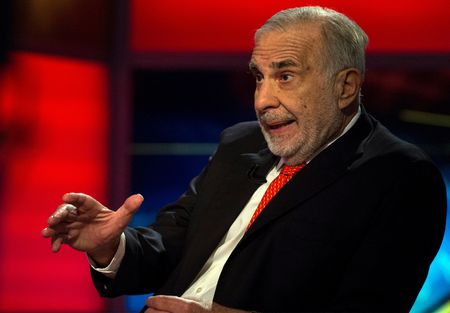

Hindenburg in May accused billionaire Carl Icahn-owned IEP of overvaluing its holdings and relying on a “Ponzi-like” structure to pay dividends. The company’s units were overvalued by more than 75%, the short seller had alleged.

The company has denied the allegations and vowed to fight back even as its shares lost nearly 60% of their value since the report was released.

IEP on Wednesday kept its quarterly dividend of $1 per depositary unit unchanged amid close investor scrutiny after Hindenburg attack. It had slashed the payout by 50% in August.

The company said it expects INAV to fall nearly 8% to $4.76 billion as of Dec. 31 from the prior quarter.

IEP chair Carl Icahn said the incoming CEO Teno has “an impressive record of stock picking and position stewardship within our investment segment”.

Teno has been a portfolio manager at Icahn Capital and is a board member of natural gas company Southwest Gas Holdings and gene-sequencing company Illumina.

He will replace David Willetts, who will head Pep Boys, one of IEP’s portfolio companies that lets provides auto repair and services. IEP acquired Pep Boys in 2015.

“David’s skill set is particularly suited to work on a day-to-day basis to drive the significant value creation potential in Pep Boys,” the billionaire activist investor said.

(Reporting by Niket Nishant in Bengaluru; Editing by Arun Koyyur)